Exactly how is obligations part of living?

Only a few financial obligation is actually crappy. Indeed, certain types of loans could possibly get reinforce your borrowing from the bank and enable you to have ideal power over your financial wellness.

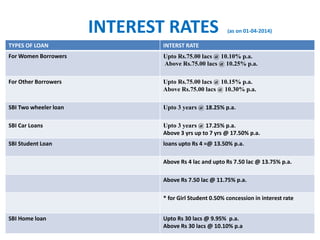

2 Pricing start around 6.40% to help you 9.80% Annual percentage rate. Your final speed will be computed predicated on the loan number, title, and credit score. Apr = Annual percentage rate. All the fund are at the mercy of credit review and you will approval and you can costs was at the mercy of changes without notice. For additional loan dismiss advice, excite consider our family savings options.

Financial degree with the principles

step three Costs and you may conditions will vary based lien position, occupancy, loan-to-really worth, assets method of, credit history, and you will loans-to-income. $75 yearly fee immediately after basic anniversary. The newest appropriate rate of interest is based on amount borrowed, credit score, and label. The new applicable rate of interest is actually listed on Wall structure Roadway Journal (WSJ) Perfect Speed and that’s at the mercy of transform toward WSJ Perfect Rates. The rate cannot exceed 18%. To have a charge off $a hundred, consumers could possibly get lock the or the main a great balance to possess a predetermined name during the a predetermined price. Household Security Lines of credit provides a draw Months and you will Payment Several months. In Mark Period, minimal payment per month was appeal merely. At the conclusion of the fresh Mark Period, this new Installment Months begins. From inside the Cost Period, the primary equilibrium, excluding before locked amounts, was amortized over a period of 15 years, that may help the payment before owed.